Strategies

Millennia’s first strategy

Marketplace Lending

The first strategy managed by Millennia is on U.S. consumer Marketplace Lending.

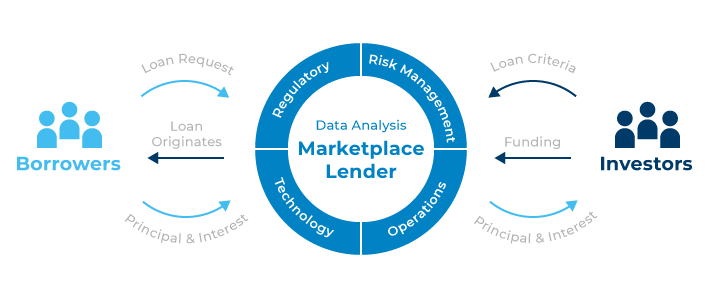

Marketplace lending (formerly known as peer-to-peer lending), is the practice of lending money to individuals or businesses through online services matching directly lenders and borrowers, disintermediating the banking sector.

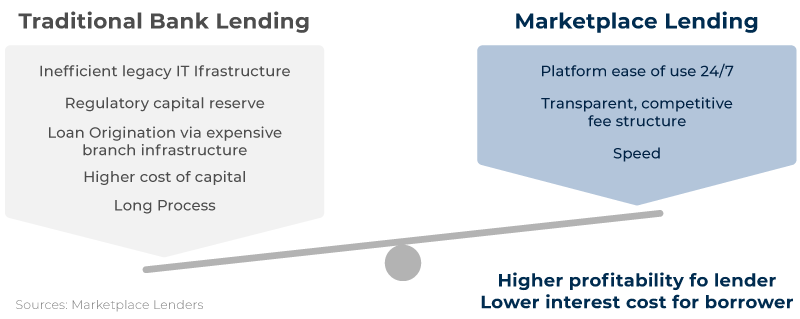

Since marketplace lenders companies offer these services entirely online, they can run mostly automated processes with relatively low overheads, making their products (loans) more affordable to consumers and offering a better, speedier service than traditional lenders.

Demand for getting exposure to these loans grew exponentially over the last 10 years due to investors’ search of yield, in a zero interest rate environment, and of uncorrelated, diversified assets. Today, marketplace consumer loans can be considered an asset class due to the size of the market (billions of US$ originated per year) and its accessibility by large institutional investors in the US.

Why choose

Marketplace Lending

Marketplace consumer lending is a spin-off of the wider personal loan market, consisting of debt issued predominantly by credit cards companies and, to a lower degree, by banks and credit unions.

All these type of lenders have consitently performed positively over the decades in the US, irrispective of the credit cycle.

Marketplace consumer loans amortize monthly and are typically used by borrowers to consolidate and refinance more expensive rolling debt such as credit card debt. Therefore, by refinancing rolling debt with a marketplace loan, typically borrowers manage to decreases the cost of exisiting debt and find a path to deleveraging in a reasonable timeframe. These beneficial features resulted in growing borrower demand for these loans.

Investor financing these loans can typically choose the level risk they want to be exposed to, stratified by different risk-grading and maturity, and benefit from attrctive yields for given risk and tenures. In fact, the monthly amortization reduces significantly the average duration and the risk of a loan, while yielding between mid single diggits to mid teens diggits depending on the risk sought. In a prevailing low yield enviroment, this risk-return aspect proved very attractive to institutional investors and, consequently, investor’s demand soar.

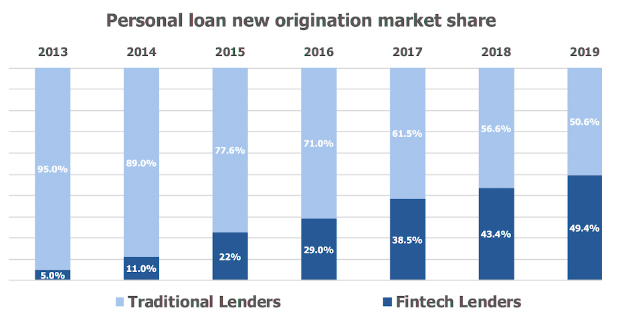

Today, marketplace loans represent about 50% of all new personal loan origination in the US.

The Pillars of Loan Underwriting

Marketplace lenders use a mix of innovative and traditional credit assessment techniques driven by big data and artificial intelligence to correctly price the interest rate of each loan depending on the individual borrower credit score and other alternative credit data. Typically, the below are main aspects of the credit risk underwriting:

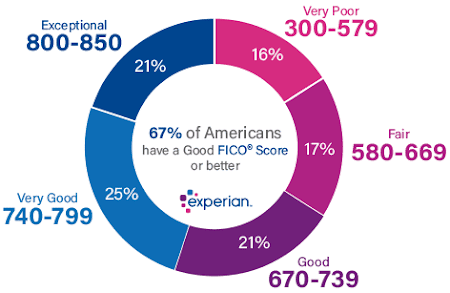

- Firstly, the applicant borrower’s personal FICO® score is checked. The FICO score represents the borrower’s credit risk derived by the personal credit history with the different credit providers (banks or others). For more information about FICO scores please click here. Marketplace lenders can access these FICO scores via the main credit bureaux TransUnion, Experian and Equifax, which together cover about 90% of the US population and receive monthly updates on individual borrower’s credit performance. A KYC/AML check is also performed at this stage.

- Secondly, the marketplace lender assigns an internal credit rating to determine the appropriate interest rate application to the loan of each borrower. This rating is determined by the FICO score and other information provided by the applicant such as income level, total debts, (and consequently, their debt-to-income ratio), the amount requested, loan term and other proprietary features driven by big data and algorithmic / artificial intelligence analysis.

- Thirdly, verification. The lender verifies the information provided by the borrower with manual and automated checks.

- Finally, once the loan is vetted, approved and priced (an interest rate is applied in function of risk) the loan is offered on the marketplace to investors